Globally, tax treatment for dividend income varies across countries. This requires investors to understand their home country’s tax policies and the tax liabilities associated with overseas investments. This article provides a detailed overview of the fundamental concepts, distribution criteria, tax advantages, and relevant regulations of Hong Kong company dividends, helping investors better understand and manage their investment returns.

What is a dividend?

Dividends are a company’s distribution of a portion of its profits to shareholders in the form of cash or stock. These distributions may occur either mid or at the end of the fiscal year. It’s important to note that directors themselves are not entitled to dividends unless they own shares in the company. Since dividends are allocated based on shareholding ratios, only directors who hold shares are eligible to receive corresponding dividends.

Dividend Condition

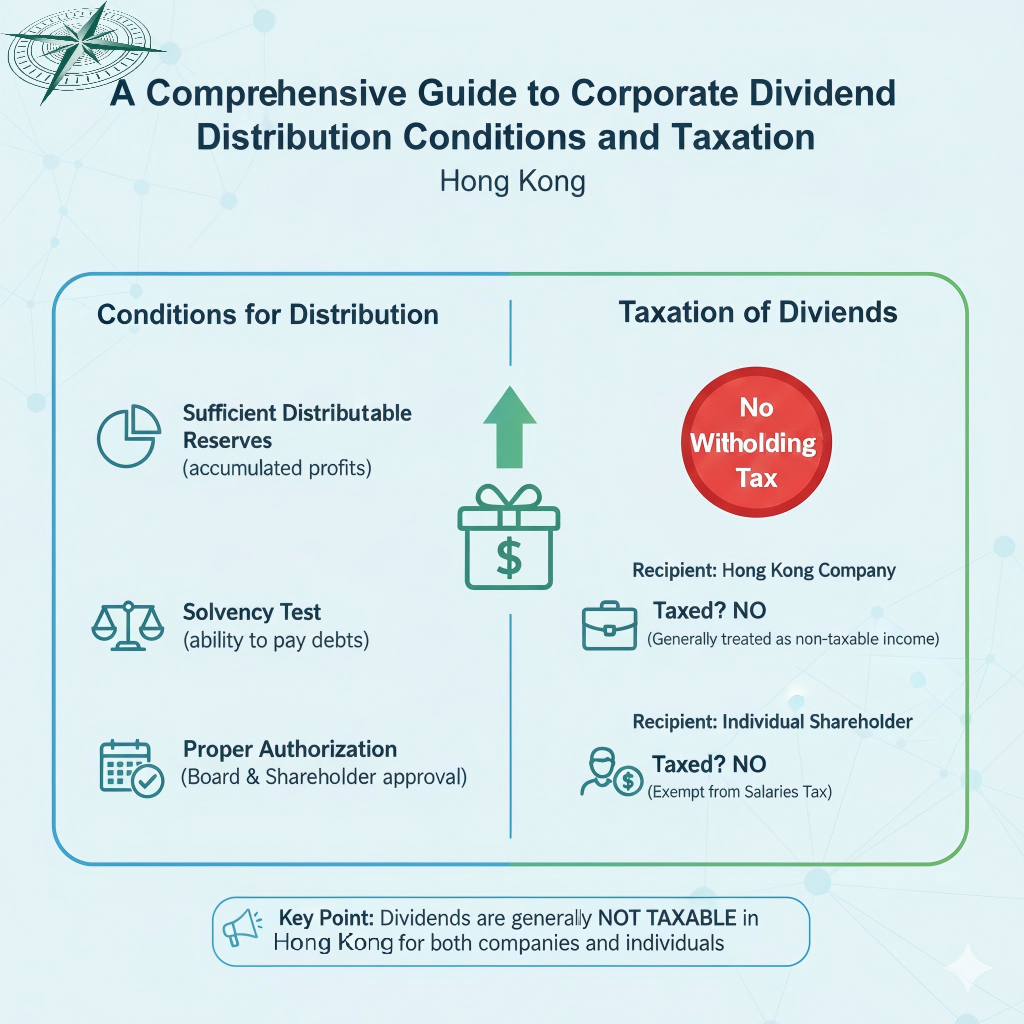

Hong Kong companies must strictly comply with the Hong Kong Companies Ordinance and their articles of association when distributing dividends to avoid legal violations.

1. Verify whether the articles of association authorize the board of directors to distribute dividends.

2. To ensure the implementation of dividend distributions in accordance with Part 6 of the Hong Kong Companies Ordinance — “Distribution of Profits and Assets”, the following key points must be ensured:

- Only accumulated retained earnings can be used to pay dividends.

- If the auditor’s opinion on the previous year’s financial statements was a qualified opinion, the auditor must issue a statement clarifying that the qualified opinion is unrelated to the company’s dividend distribution.

- If the interval between the last audit date and the dividend distribution date is too long, the board may prepare interim financial statements to complete the distribution. It is generally recommended to prepare these statements within three months prior to the distribution.

These provisions are designed to ensure that companies can fulfill their financial obligations when distributing dividends without facing capital shortages, thereby safeguarding creditors’ interests. The specific provisions under Sections 290 and 291 of the Hong Kong Companies Ordinance guarantee the legality and transparency of dividend distributions.

The specific provisions of Part 6 of the Hong Kong Companies Ordinance are as follows:

Article 290: A company may only distribute dividends when it has accumulated redeemable surplus, ensuring its ability to meet creditor obligations post-distribution.

Article 291: A company may only pay dividends from distributable profits and shall not pay dividends from its capital.

The specific provisions of Section 406 of the Hong Kong Companies Ordinance are as follows:

Article 406: If the auditor’s opinion on the previous year’s financial statements was a qualified opinion, the auditor must issue a statement clarifying that the qualified opinion is not related to the company’s dividend distribution.

These provisions ensure that companies can fulfill their financial obligations when distributing dividends without facing capital shortages, thereby effectively safeguarding creditors ‘interests. Meanwhile, by preparing timely financial statements, the board of directors can accurately assess the company’s financial status and make more informed decisions.

Is dividend from Hong Kong companies taxed, and what is the tax rate?

1. Dividend to individual

- Hong Kong resident shareholders: No additional taxes required.

- Mainland Chinese shareholders: Subject to a 20% withholding tax on personal income. However, if the Hong Kong company is a listed entity and the mainland Chinese shareholder holds the shares for over one year, the personal income tax is exempted.

- For other foreign nationals: The applicable personal income tax policy depends on their nationality. For example, U.S. residents are required to file taxes on their global income under the Foreign Account Tax Compliance Act (FATCA).

2. Dividends to the company

- Hong Kong company shareholders: No additional taxes required.

- Mainland company shareholders: Mainland enterprises are subject to a 25% corporate income tax rate. Under the Mainland-Hong Kong double taxation avoidance agreement, only the difference in tax liability needs to be paid, provided the Hong Kong company obtains Hong Kong tax resident status.

- Companies from other countries or regions: The applicable tax rate shall be determined in accordance with local policies.

Can corporate dividends be tax-deductible?

Dividends are a company’s distribution of a portion of its profits to shareholders in the form of cash or stock. These distributions may occur either mid or at the end of the fiscal year. It’s important to note that directors themselves are not entitled to dividends unless they own shares in the company. Since dividends are allocated based on shareholding ratios, only directors who hold shares are eligible to receive corresponding dividends.

Furthermore, it should be emphasized that under the Hong Kong Inland Revenue Ordinance, dividend distributions are not deductible expenses. This means companies cannot deduct the distributed dividends when calculating taxable income. As stipulated in Section 16 of the Hong Kong Inland Revenue Ordinance:

Section 16 of the Tax Ordinance (Non-deductible Expenses):

Unless otherwise provided in these Regulations, any dividend paid by a company, whether in cash or in stock, shall not be deductible as an expense of the company.

This regulation aims to prevent companies from using dividend distributions to reduce taxable income, thereby ensuring tax fairness. Therefore, when distributing dividends, companies must consider the impact on their tax status.

Frequently Asked Questions (FAQ)

Is dividend tax applicable to Hong Kong stock dividends?

In Hong Kong, Hong Kong companies typically do not impose additional dividend tax on dividends distributed to Hong Kong resident shareholders. Under the territorial origin principle, dividend income is not considered taxable income generated or derived from Hong Kong. However, non-Hong Kong resident shareholders, such as mainland Chinese residents or other foreign nationals, are subject to tax treatment of their dividend income based on their place of residence tax laws and tax agreements between Hong Kong and their respective jurisdictions. For instance, mainland Chinese shareholders may be required to pay personal income tax under mainland tax laws, with specific tax rates and exemptions determined by applicable regulations.

Is dividend tax required after receiving dividends in Hong Kong?

Hong Kong residents receiving dividends from Hong Kong companies are generally exempt from filing separate tax returns with the Inland Revenue Department, as Hong Kong does not impose additional taxes on dividends. However, if you are a company shareholder receiving dividends from other Hong Kong companies, such dividend income is tax-exempt in Hong Kong. Nevertheless, all transactions involving corporate income and expenses must be properly recorded in the company’s accounting records and handled in accordance with accounting standards during annual tax filing. If you are a tax resident in other countries or regions, you should determine whether you need to file taxes on Hong Kong dividend income based on your local tax regulations and explore any applicable double taxation agreements.

What is Hong Kong’s dividend tax policy?

Hong Kong’s tax system is relatively simple with low rates, featuring a key characteristic: the absence of dividend tax. This means companies typically don’t need to pay additional taxes on dividend income when distributing dividends to shareholders, particularly Hong Kong residents. This policy helps attract investment and boost business activities. However, it’s important to note that while Hong Kong itself doesn’t levy dividend tax, shareholders from other countries or regions may be required to pay taxes on their dividend income under local tax laws. Additionally, dividends distributed by companies cannot be deducted as tax-deductible expenses when calculating profits tax. This means that after distributing dividends from pre-tax profits, the taxable profit base remains unchanged.