Every limited company registered in Hong Kong must file tax returns with the Inland Revenue Department (IRD) annually, regardless of its operational status. Eligible “inactive companies” —those with no business activities (no transactions, income, or expenses) throughout the year—may apply for “zero declaration.” This article provides a detailed explanation of what “zero declaration” and “inactive companies” entail, along with the audit and tax filing process and key considerations. It helps you avoid common pitfalls and understand your company’s tax obligations.

What is “zero declaration”?

All limited companies registered and operating in Hong Kong must file annual profit tax returns with the Inland Revenue Department (IRD) each fiscal year. A ‘Nil Return’ refers to a declaration in which the company states that no business profits were generated or derived from Hong Kong during the tax year. This allows the company to qualify for an exemption from the standard accounting, auditing, and tax obligations required of general limited companies.

What are the eligibility criteria for zero declaration?

A valid “zero declaration” must be based on the company having no commercial activities, no bank transactions, or no asset changes throughout the year. When applying, the company must be certified as a “non-activity company”, meaning:

- The company is registered but not yet operational

- Business suspended but not deregistered

- pure holding

Note that such companies must still file tax returns on time, accompanied by audited financial statements.

Can Non-Active Companies File Zero Declaration?

To qualify for the ‘zero declaration’ scheme, companies must demonstrate they are ‘non-activity entities’ —meaning they have no income, business operations, operating expenses, or asset changes, and their financial statements accurately reflect this ‘zero activity’ status.

Can small amounts of bank interest or fees still be declared as zero?

Regardless of the amount, all bank interest and fees shall be treated as taxable income or deductible expenses. A company is deemed ineligible for zero declaration if any of the following conditions apply:

- There is a bank interest (even $1);

- There are expenses such as accounting, secretarial and annual report;

- There are bank transfers and investment operations;

- The assets generate returns (e.g. rent, dividends).

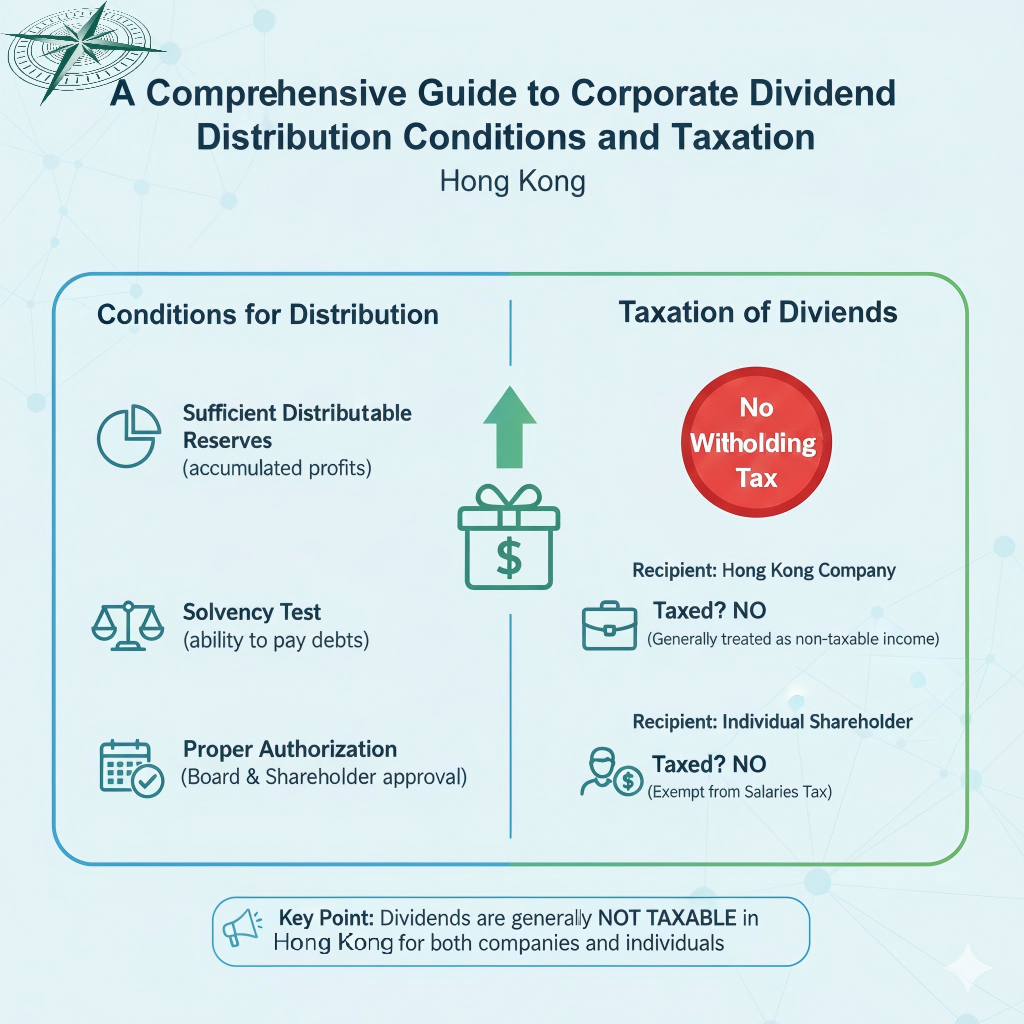

Under what circumstances can a limited liability company not file a zero return?

The ‘Zero Declaration’ scheme applies exclusively to Hong Kong Limited Companies with no business operations whatsoever. Companies engaged in any business activities or bearing operational expenses are ineligible. The following circumstances will disqualify a Limited Company from applying for the ‘Zero Declaration’:

- If there is no income but there are expenses (such as accounting fees, secretarial fees), the actual loss should be declared;

- Conducting banking transactions or investment operations is considered a business activity.

- When assets generate returns (e.g. rent, dividends), taxable profit must be calculated.

2025 Tax Compliance Update: Audit Reports Are Mandatory!

The Tax Bureau enforces strict compliance: all limited companies must submit tax returns accompanied by audited financial statements, regardless of operational status. Even for ‘zero activity’ cases, a certified public accountant’s audit report must confirm’ zero income, zero expenses, and zero profit.’ Failure to provide such an audit report constitutes incomplete filing, which may result in tax return rejection or penalties.

Complete the zero declaration tax filing process in just four steps

To file a ‘zero return’ (zero declaration), you must strictly comply with the Hong Kong Inland Revenue Department’s requirements, particularly the mandatory inclusion of an audited report effective from 2023. Here are four straightforward steps to complete your’ zero return’ and ensure tax compliance:

l Determine if the company qualifies for zero declaration

To verify whether a company qualifies as a “non-activity company” for the full year, it must demonstrate complete absence of operating expenses, commercial activities, bank transactions, or asset movements, with financial statements accurately reflecting “zero activity”. Any presence of operational activities, expenditures, bank interest, or asset returns disqualifies the company from “zero declaration” eligibility.

- prepared audited financial statements

Even without transactions, a balance sheet and income statement must be prepared and audited by an auditor to demonstrate ‘zero revenue, zero expenses, zero profit.’ Without an attached audit report, the declaration will be deemed incomplete, potentially leading to the return of the declaration or a fine.

l Fill out the BIR51 Profit Tax Return

Enter “0” in the “Taxable Profit” field and check the relevant declaration to confirm no taxable activities. For details, refer to the BIR51 Filling Guide.

l Submit to the tax authority on time

Tax returns are typically filed within one month of receipt. Small businesses may apply electronically for tax filing extensions, with periods ranging from several months to up to 11 months depending on the company’s fiscal year-end month.

Conclusion and Action Recommendations

While ‘zero declaration’ may seem straightforward, it requires absolute precision. This policy applies only to companies with zero operational activities. Any misstep could trigger tax audits, penalties, or even reputational damage. Proactively seeking professional advice is far more prudent than dealing with the aftermath.